For New DiskarTech Clients

How much can I avail?

You can get approved for PHP 20,000 up to PHP 500,000 payable in 6 or 12 monthly installments. The approved loan amount and term will be displayed in the Pasado Portal after your loan application. An SMS will be sent to your registered mobile number about your loan offer.

Magkano ang pwede kong i-avail na loan?

Pwede kang ma-approve para sa loan na nagkakahalaga mula Php 20,000 hanggang Php 500,000, payable ng 6 or 12 monthly installments. Ang approved loan amount at term ay makikita sa Pasado Portal pagkatapos ng iyong loan application. Makakatanggap ka ng text sa iyong registered mobile number tungkol sa loan offer.

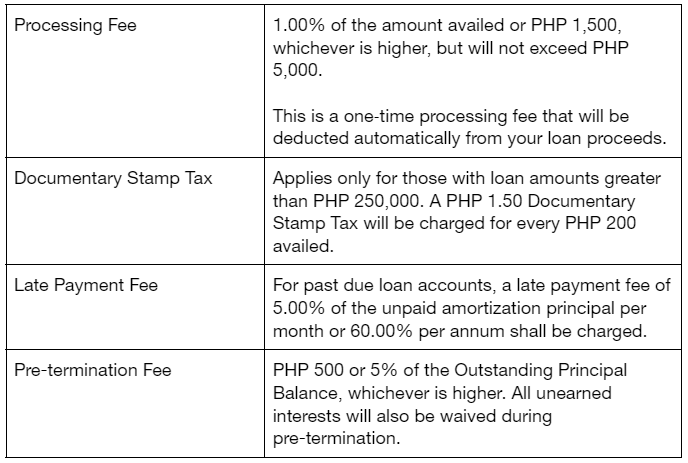

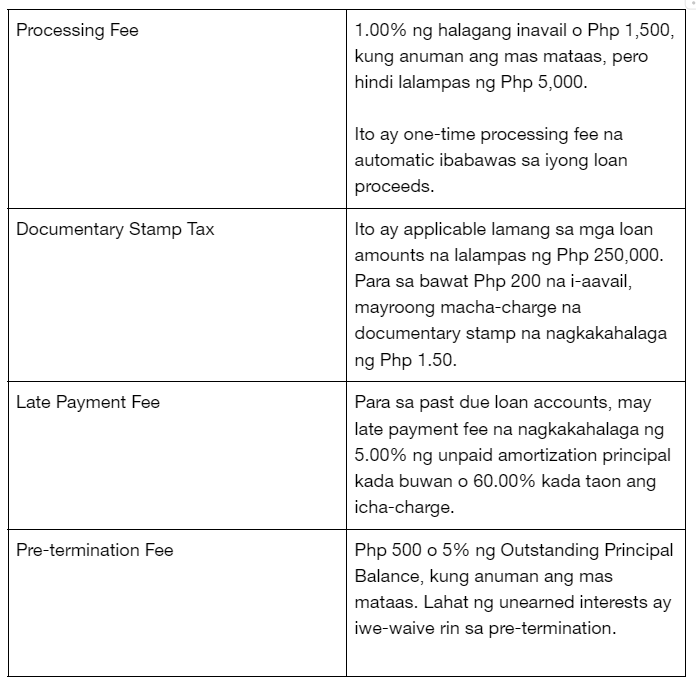

What are the fees and charges of a Pasado Loan?

Ano ang mga fees at charges ng Pasado Loan?

What are the interest rates?

The monthly interest rate ranges from 1.58% to 2.83% or approximately 19.00% to 34.00% Effective Interest Rate (EIR) per annum.

Ano ang mga Interest Rate?

Ang monthly interest rate ay nagkakahalaga mula 1.58% hanggang 2.83% o approximately 19.00% hanggang 34.00% effective interest rate per annum.

Who is eligible for a Pasado Loan?

Any [non-US person] employed or self-employed Filipino citizen aged 21 to 65* years old who have yet to avail of a Personal Loan from RCBC.

*65 years old upon loan maturity

Sino ang qualified para sa Pasado Loan?

Isang [non-US person] na employed o self-employed Filipino citizen edad 21 hanggang 65* years old na mag-aavail pa lamang ng Personal Loan mula sa RCBC.

*65 years old upon loan maturity

How will I know if I am qualified for a Pasado Loan?

Simply go to pasado.ph → click Apply Now → select a Desired Loan Amount and Term → click Continue → enter a Promo Code or Skip → read the Terms and Conditions → click I Agree → enter your Mobile Number → enter the correct OTP → complete the Forms (Complete Name, Personal Information, Home Address, Work Information) → click Next → view your Pasado Results

Once you’re qualified (a.k.a. Pasado), simply download the DiskarTech app and create a DiskarTech account using the mobile number entered in the Pasado website (Pasado Portal)

Paano mag-apply ng Pasado Loan?

Pumunta sa Pasado.ph → click Apply Now → Piliin ang Desired Loan Amount at Term → Click Continue → Ilagay ang Promo Code o Skip → Basahin ang Terms and Conditions → Click ‘I Agree’ → Ilagay ang iyong Mobile Number → Ilagay ang tamang OTP → Kumpletuhin ang Forms (Complete Name, Personal Information, Home Address, Work Information) → click Next → tignan ang iyong Pasado Results

Kung qualified ka na (a.k.a. Pasado), maaari mong idownload ang DiskarTech App at gumawa ng DiskarTech account gamit ang mobile number na inilagay mo sa Pasado website (Pasado Portal).

How can I avail the loan once I am “Pasado”?

Once you are qualified for the Pasado Loan, simply download the DiskarTech mobile app from the App Store or Google Play Store. Create an account using the mobile number entered during the loan application in the Pasado Portal. When you already have a fully verified DiskarTech account, click on the “Pasado”, “Apply ng Loan”, or “Loans” buttons in the DiskarTech dashboard.

Paano ako makakapag-avail?

Kapag qualified ka na sa Pasado Loan, i-download ang DiskarTech mobile app mula sa App Store o Google Play Store. Gumawa ng account gamit ang mobile number na inilagay sa loan application sa Pasado portal. Kapag meron ng fully verified DiskarTech account, i-click ang “Pasado”, “Apply ng Loan”, o “Loans” buttons sa DiskarTech Dashboard.

What requirements do I need to submit?

You only need to submit one (1) Philippine government ID during the creation of a DiskarTech account.

- Philippine Passport

- LTO Driver’s License

- Unified Multi-Purpose ID (UMID)

- Social Security System (SSS) ID

- NBI Clearance

- PhilPost Postal ID (issued 2016 onwards)

- Professional Regulation Commission (PRC) ID

- Integrated Bar of the Philippines (IBP) ID

- Seaman’s Book

- National ID (PhilSys/PhilID)

- Printed National ID (ePhilID)

- QCitizen ID

Anong mga requirements ang kailangan kong i-submit?

Ang kailangan mo lang ay isang (1) Philippine government ID sa paggawa ng DiskarTech Account.

- Philippine Passport

- LTO Driver’s License

- Unified Multi-Purpose ID (UMID)

- Social Security System (SSS) ID

- NBI Clearance

- PhilPost Postal ID (issued 2016 onwards)

- Professional Regulation Commission (PRC) ID

- Integrated Bar of the Philippines (IBP) ID

- Seaman’s Book

- National ID (PhilSys/PhilID)

- Printed National ID (ePhilID)

- QCitizen ID

How soon do I get the proceeds?

Once fully verified in DiskarTech, you will get the proceeds, net of fees, in an instant. You will receive this as soon as you agree with the Terms and Conditions, Promissory Note, and Disclosure Statement.

Gaano kabilis ko makukuha ang inavail na loan?

Kapag fully verified na sa DiskarTech, agaran mo nang makukuha ang loan amount na net ng fees. Matatanggap mo kaagad ang amount kapag nag-agree ka na sa Terms and Conditions, Promissory Note, at Disclosure Statement.

After I received my loan, what are the methods available to withdraw my funds?

You can withdraw cash through any RCBC ATMs or ATM Go Terminals via QR Code or Reference Number Cardless Withdrawal. You may also transfer your funds to your RCBC account/s or other bank accounts via fund transfer.

Pagkatanggap ko ng loan, ano ang mga available methods para makapag-withdraw ng funds?

Pwedeng i-withdraw ang iyong cash saanmang RCBC ATMs o ATM Go Terminals gamit ang Cardless Withdrawal via QR Code o Reference Number. Pwede mo ring i-transfer ang funds sa iyong RCBC account/s o ibang bank accounts gamit ang fund transfer.

How will I pay for my monthly amortizations?

We’ve made it easy for you to pay your loan as this will be automatically deducted from your DiskarTech Basic Deposit Account (BDA) or Regular Savings Account (RSA).

You may also pay in advance by simply Logging into DiskarTech → Click on the Pasado button → Click “Bayaran” on the bottom right corner of the Pasado Loan dashboard → Select Monthly or Full Payment → Slide to Confirm → Enter the correct One-time Password (OTP) → Review the Payment Receipt.

Paano ako magbabayad ng monthly amortizations?

Mas madali nang makapagbayad ng loan mo dahil automatic na ibabawas na ito mula sa iyong Diskartech Basic Deposit Account (BDA) o Regular Savings Account (RSA).

Maaari ka ring magbayad in advance. Maglog-in lamang sa DiskarTech → Click ang Pasado Button → Click “Bayaran” sa bottom right corner ng Pasado Loan dashboard → Piliin ang Monthly o Full Payment → Slide para i-confirm → Ilagay ang tamang One-Time Password (OTP) → I-review ang payment receipt.

How will I know my payment schedule?

You may refer to the DiskarTech app for your payment schedule and progress. You may access this by logging in to your DiskarTech account → Go to the “Pasado” or “Loans” tab → See your Loan Amortization Schedule.

Paano ko malalaman ang payment schedule?

Pwede mong i-check sa DiskarTech App ang iyong payment schedule at progress. Maglog-in sa iyong DiskarTech account → Pumunta sa “Pasado” o “Loans” Tab → Tignan ang iyong Loan Amortization Schedule.

What is the validity of my Pasado Loan offer?

You have 90 days from the date you first received the offer to avail your loan.

Ano ang validity ng Pasado Loan Offer ko?

Mayroon kang 90 days mula sa araw na natanggap mo ang offer para ma-avail ang iyong loan.

What if I am not qualified?

If you are not qualified for Pasado Loan, you may still create a DiskarTech Regular Savings Account (RSA). You may also try to reapply for a Pasado Loan after 90 days from your initial application.

Paano kung hindi ako qualified?

Kung hindi ka qualified para sa Pasado Loan, maaari ka pang gumawa ng DiskarTech Regular Savings Account (RSA). Pwede ka ring magre-apply para sa Pasado Loan 90 days mula sa una mong application.

Can I avail of a Pasado Loan even if I have an existing loan?

You can avail of a Pasado Loan even if you have an existing Home Loan and Auto Loan as long as you are qualified and have maintained a good credit standing. However, existing Personal Loan and Salary Loan borrowers are ineligible for a Pasado Loan.

Pwede ba akong makapag-avail ng Pasado Loan kahit may existing loan na ako?

Kung ikaw ay qualified at nakapag-maintain ng good credit standing sa RCBC, pwede kang mag-avail ng Pasado Loan kahit may existing Home Loan at Auto Loan ka.

Ang mga existing Personal Loan at Salary Loan borrowers ay hindi qualified mag-apply para sa Pasado Loan.

How do I change my account information in DiskarTech?

You may request for account information update by emailing [email protected].

Paano ko babaguhin ang account information ko sa Diskartech?

Mag-email sa [email protected] para mag-request ng account information update.

Who should I contact in case of any issues encountered in the Pasado Portal or the DiskarTech mobile app during loan application and processing?

For inquiries on your loan approval status, approved loan amount, and approved loan term, as well as questions, concerns, and issues on loan availment and payments, please contact RCBC Bankard Customer Care.

RCBC Personal & Salary Loans

+632 8888 1895

For questions, concerns, and issues regarding the Pasado Portal or the website and account creation in DiskarTech, please reach out to DiskarTech Customer Care.

DiskarTech Customer Care

Sino ang pwedeng tawagan kapag may mga isyu akong naencouter sa Pasado Portal o DiskarTech mobile app sa loan application at processing?

Para sa mga tanong tungkol sa iyong loan approval status, approved loan amount, at approved loan term; mga concerns at isyu sa loan availment at payments, please contact Bankard CustomerCare.

RCBC Personal & Salary Loans

+632 8888 1895

Para sa mga tanong, concerns, at mga isyu tungkol sa Pasado Portal o website at account creation sa DiskarTech, please contact DiskaTech Customer Care.

DiskarTech Customer Care