Island communities across the Philippines are set to receive access to financial services and renewable energy as Rizal Commercial Banking Corporation’s (RCBC) DiskarTech and One Renewable Energy Energy, Inc. (OREEi) seal a partnership that is estimated to benefit over 20,000 Filipinos residing in these areas.

One of these remote islands is Malalison, in Culasi, Antique which, through OREEi’s initiatives in partnership with the Asian Development Bank (ADB) and the local government, now enjoys 24/7 access to electricity from their previous four hours a day. This will have tremendous effects in opening up economic and social development opportunities for Malalison and all other islands.

Through the country’s first Taglish super app DiskarTech and ATM Go, both being digital products of RCBC, residents in Malalison will now also have access to financial services.

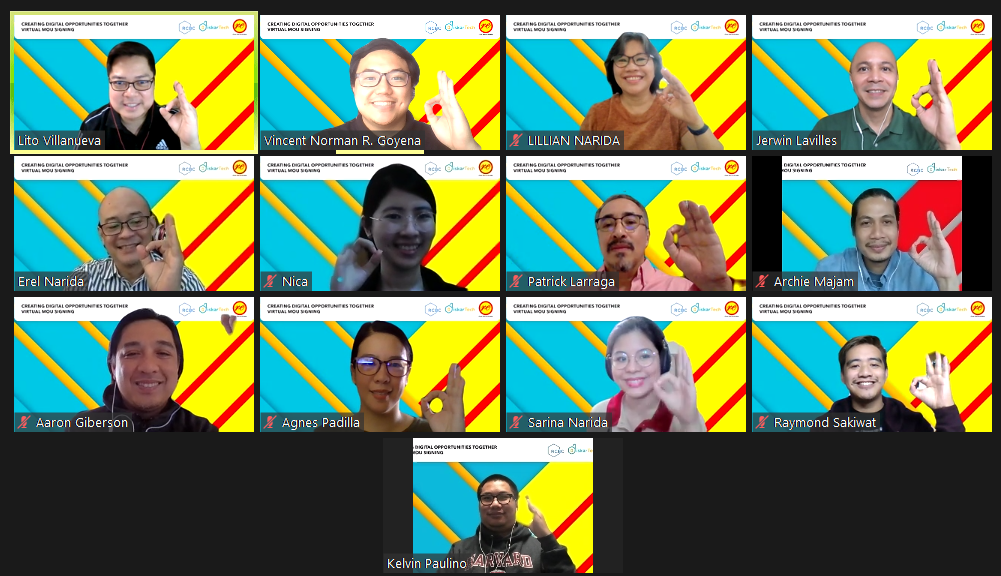

“This partnership is part of our mission to promote inclusive digital finance to our unbanked and underserved kababayans. Serving the OREEi communities and widening the reach of Diskartech will help us in achieving this objective,” said Lito Villanueva, RCBC’s executive vice president and chief innovation and inclusion officer.

This partnership is also part of RCBC’s commitment to the United Nations Sustainable Development Goals (SDGs) covering Goal 7: Affordable and Clean Energy; Goal 9: Industry, Innovation and Infrastructure; Goal 10: Reduced Inequalities; Goal 11: Sustainable Cities and Communities; and, Goal 17: Partnerships.

Innovation, and Partnership for the Goal

The DiskarTech app allows users to open a digital savings account that requires no initial deposit, maintaining balance or dormancy fees. It also offers digital financial services like bills payment, cash in, cash withdrawal, airtime and gaming e-load, fund transfers, and insurance, among others.

ATM Go, on the other hand, is a portable point-of-sale (POS) device deployed to accredited rural banks, pawnshops, cooperatives, and sari-sari stores to perform automated teller machine (ATM) functions to BancNet cardholders. These services include withdrawals, cash deposits, balance inquiries, bills payment, fund transfer, and e-loading.

This partnership will be made in cooperation with Posible, one of RCBC’s ATM Go partners with an existing network in the remote locations where ORE is present. Posible will serve as the main digital partner which will cater to the financial needs of the residents in ORE communities.

With this partnership, members of the community will also be able to earn from offering instant digital financial or “Paki-suyo” services in their respective neighborhoods and performing financial transactions on behalf of others through the DiskarTech digital app.

Affordable and Clean Energy, and Reducing Inequality

OREEi, a proponent of transformational growth in uplifting communities and their livelihood, designs, integrates, and installs various renewable energy products and services in residential, agricultural, industrial, and communal applications.

“What drives OREEi is the use of renewable energy for the creation of an ecosystem for sustainable growth. Due to the – off-grid nature of the communities we serve, banks and other financial institutions are not easily accessible. By partnering with RCBC’s Diskartech we are confident that we can finally bring financial services to these communities which will further encourage and empower them to grow in a sustainable manner.” said Erel Narida, ORE’s President and Chief Executive Officer.

“Posible is committed in supporting the needs of the Filipinos across the country. This partnership will further strengthen our current services in OREEi communities,” said Jerwin Lavilles, Posible’s Head of product design and development.

Sustainable Cities and Communities

Apart from Malalison, islands in Southern Luzon, Visayas, and Southern Mindanao are also set to receive the same renewable energy and financial services.

“With the support of the local community, we’ve developed a model of development that utilizes renewable power as a catalyst for development. We’d like to be able to replicate this model in many other islands,” Narida said.

DiskarTech recently made history as the fastest local finance app to reach two million downloads in barely twho months from its market launch while ATM Go! is set to be a standard service in covering all provinces nationwide. “Our digital services will always be a commitment to the Filipinos in helping every city and community in the country achieve growth through sustainable means,” Villanueva said.