Opening a savings account is now made much easier and more convenient as Rizal Commercial Banking Corporation (RCBC) introduces its financial super app DiskarTech! It is now possible to open a savings account anywhere you are, anytime using your smartphone in as fast as 3 minutes or less.

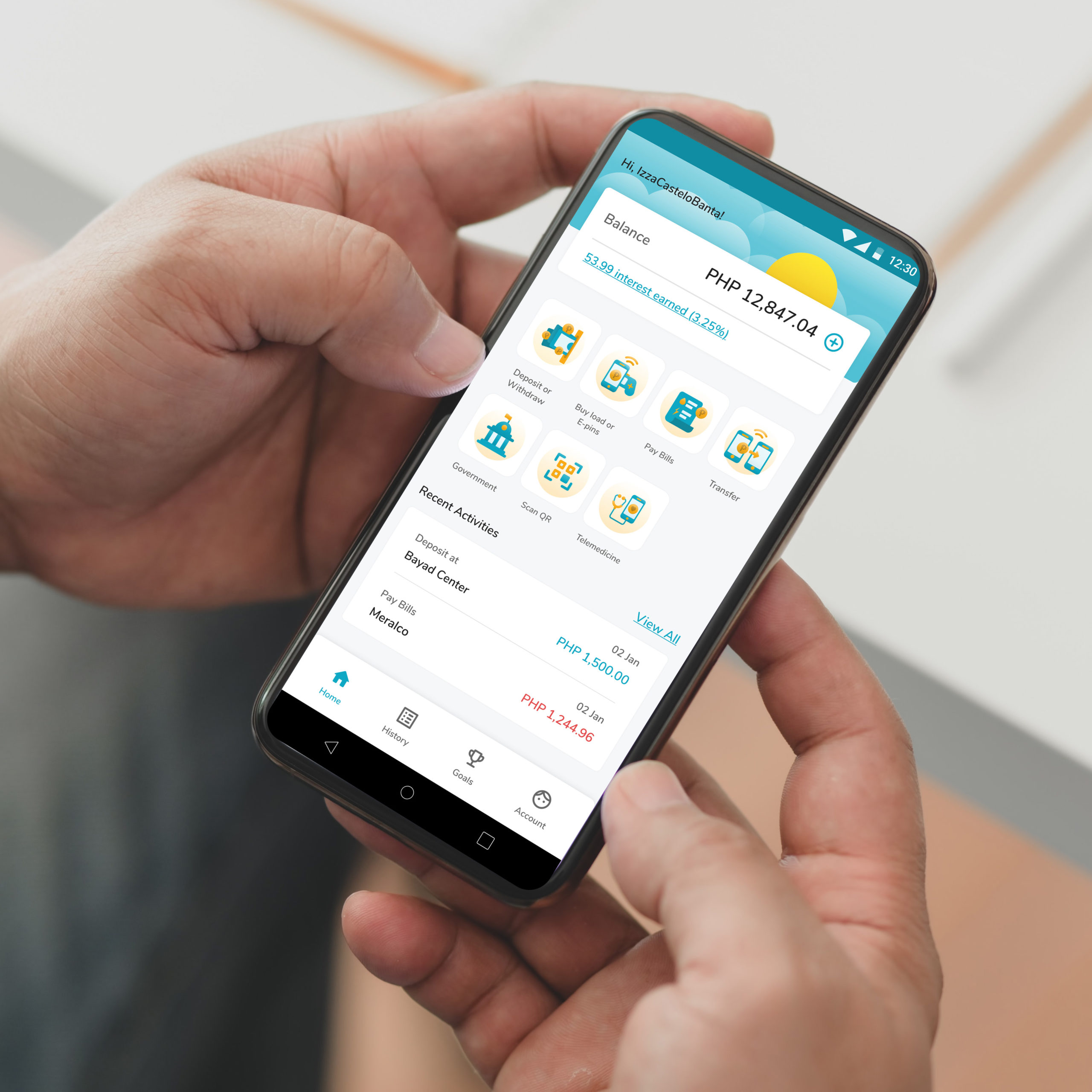

DiskarTech is a mobile app that is strategically designed to serve as a reliable and convenient platform for multiple uses. It can facilitate access to sachet banking products, digital banking services (savings, money transfers, and payments), and even quick healthcare solutions.

As a deposit-savings account, users can enjoy an annual interest on savings of 3.25%, which is higher compared to interest applied on most traditional bank savings accounts. Deposits can be coursed through 7-Eleven stores, Bayad Center sites, eBiz partners, and a number of partner-pawnshops nationwide. If you need to withdraw cash, you can do so through cardless withdrawals from any RCBC ATM machine or simply cash out from thousands of partners across the country.

DiskarTech introduces an innovation through #BuhayGinhawa, a goal-oriented online savings tracker that enables users to set ènancial goals. The super app can help plan and determine how much you will need to save per week or month for you to be able to meet financial targets.

Other financial features

Real-time fund transfers to other DiskarTech users can be done much faster via the super app’s quick response (QR) code transfers. It also facilitates transferring of funds to over 30 banks and mobile wallets using InstaPay. Users can perform other ènancial transactions through DiskarTech like bills payments, buying of airtime load and gaming pins, and even paying insurance premiums. You can also pay several government bills through the app.

DiskarTech has a partnership with digital clinic iDoc, enabling it to offer affordable healthcare packages (as low as P799.20 annually). You can use this to access immediate off-site and online medical consultation and assistance from the best doctors in various medical fields.

Through a partnership with the Department of Trade and Industry, DiskarTech users can now make deposits or cash-in and cash-out transactions through any of over 3 million partner retailers or sari-sari stores nationwide. Those small stores can also facilitate e-load, bills payment, fund transfers, insurance payments, and loan repayment transactions for customers through the super app.

Serving unbanked Filipinos

“DiskarTech is a virtual banking platform that aims to reach the grassroots level and target a million new customers by the end of the year,” said RCBC EVP and Chief Innovation and Inclusion Officer Lito Villanueva during the online media launch of the super app on August 19, 2020. As of August 7 (or about a month after its soft launch), the virtual bank has already generated 1,031,821 users, with a download rate of as high as 1.3 downloads per second. No wonder, it topped the free finance apps list in Google Play in its first month.

Based on data from the Bangko Sentral ng Pilipinas (BSP), up to 77.4% of Filipinos (or 52.8 million) still don’t own formal bank-savings accounts (as of end of year 2017). Of those, 60% have insufficient money to open and maintain a bank account.

DiskarTech is one of the modern fintech products that aim to help more Filipinos access savings and financial accounts. The super app requires less documentation and no opening and maintaining balance (no penalties as well). Unlike most other fintech apps we know today, it still does not impose fees when a user reaches a certain amount in deposits and transactions per month.

Moreover, as a financial inclusion app, it is the first of its kind to use a more understandable language—a combination of English and modern local vernacular—to make the service much easier to use and understand.

How to open a DiskarTech account now

To create or open an account, download the DiskarTech app for free (Google Play Store for Android device users and App Store for iOS device users). Take note that the app uses one-time registration via electronic know-yourcustomer (eKYC) process so be sure to intend to open a single account for your perusal using any valid ID. Follow these simple steps to get started:

- Open the app and click ‘Gumawa ng Account’ (Create an Account).

- Provide your name (preferred nickname).

- When asked for a DiskarTech NegosyanTech Code, enter: AAVG7755

- Provide your mobile number. Enter the one-time password to be sent to that number.

- To upgrade your account to a verièed one, take a photo of the front and back of your ID (wait for the app’s queue) —could be any of the following: postal ID, UMID, SSS, PRC, Driver’s License, passport, TIN, or voter’s ID.

- You will be asked to record a video selfie (only a few seconds) by the app for added verification.

- Wait for a few seconds to complete the verification process. You will instantly get a notification that you are verified and could start depositing funds to your DiskarTech account.

Source: http://techandlifestylejournal.com/rcbc-diskartech-super-app/