By Adam Laurena, The Freeman

MANILA, Philippines — Most Filipinos have always aimed to achieve financial success, especially in these trying times amid ongoing health crisis.

Whether it is through opening a business or finding success in their careers, our countrymen work hard to earn for the future of themselves and their loved ones.

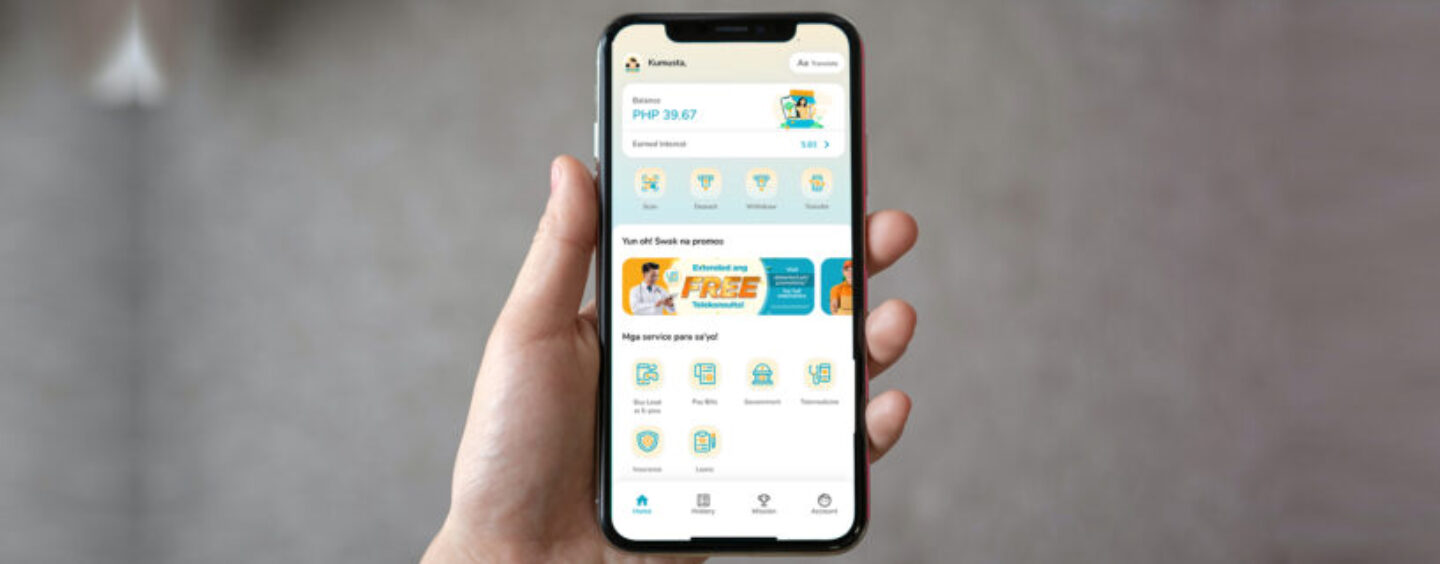

With that, the Rizal Commercial Banking Corporation (RCBC) is there for Filipinos’ financial needs through DiskarTech, a reliable and convenient financial inclusion app that will be of assistance in their journey towards financial success.

Known as the Philippines’ first and only Tagalog-English app with Cebuano translations, DiskarTech is equipped with tons of features, including fund transfers, insurance, loans, telemedicine, e-load and bill payment services.

Launched in July 2020, DiskarTech aims to make banking more available to Filipinos who do not use or do not have access to mainstream financial services, like opening savings accounts and the like, particularly those who live in far-off provinces.

Through the app, users can open up a savings account, deposit or withdraw money, pay bills, buy insurance and many more. DiskarTech, overall, aims to bring financial inclusion and introduce digital literacy to the masses.

DiskarTech is here to provide safe, convenient and secure financial services through their many features and support and enable livelihoods through their loans and PakiSuyo services.

So, what can users expect from one of the new financial inclusion apps in the country?

1. Money saver

Saving for your future can be overwhelming and you might have no idea where to start.

Thankfully, DiskarTech offers an interest rate of 3.25% per annum. This encourages their users to save their money by simply keeping it in their DiskarTech accounts. Moreover, no minimum deposit or maintaining balance is required and there are also no charges for dormant accounts.

The financial inclusion app also has cash-in and cash-out options, allowing users to deposit and withdraw money in the app, as well as transfer funds to different banks and other mobile wallet apps.

Additionally, DiskarTech also has a feature where you can set up goals on how much money you want to save and the target date you wish to achieve it. There, you can also add the purpose of your saving, as well as a photo, if you wish to be motivated to save even more.

2. Convenience at its finest

DiskarTech is more than just a savings account. It is also an app where you can pay bills, buy load, get insurance, apply for loans and enjoy telemedicine services.

For buying load, users only need to input their mobile number and choose the load denomination or promo they want to purchase. Moreover, they can also buy e-pins and e-load for online games and other entertainment apps.

When it comes to paying bills, users only need to select the biller and enter their payment details. Currently, DiskarTech users can pay close to 50 billers on the app.

DiskarTech also offers affordable insurance plans and convenient telemedicine services, the latter granting the user to contact health care providers and have access to online medical services.

It also offers different loan products to fund one’s small business.

Lastly, it can cater to a more nationwide audience, being the first Tagalog-English financial super app with Cebuano translations.

3. A source of livelihood

It won’t be DiskarTech without diskarte. Small businesses around the country can gain additional revenue with the app’s PakiSuyo service, where they can charge a minimum convenience fee for every transaction one does with them through the app.

Such transactions include a cash-in or cash-out service, bills payments, purchase of insurance, telemedicine or e-loading.

DiskarTech also gives users the option to buy loans which they can rely on during these uncertain times.

Whether it is an agricultural loan, a housing loan, a negosyo loan or an auto/motor loan, DiskarTech is there to be of assistance.

Financial assistance by their side

Amid financial troubles, RCBC’s DiskarTech will always be by the average Filipino consumer’s side, whenever and wherever, aiming to offer financial assistance and provide fast, secure and convenient services for all their users.

Whether it be loans, savings or business, DiskarTech is there to help you through your goal towards financial success.

“We need to understand the customer’s pain points while, at the same time, anticipating their needs. To innovate with empathy has already become a part of RCBC’s transformative culture. In 2022, our commitment is unrelenting efforts in accompanying more Filipinos toward shared prosperity,” RCBC Executive Vice President and Chief Innovation and Inclusion Officer Lito Villanueva said.

So, what are you waiting for? Get some financial assistance with DiskarTech now!

See full post here.