By Lito Villanueva

Helen Yuchengco-Dee, once told me: “Even when the sea seems calm, wear a life jacket.” This maxim has been at the core of Rizal Commercial Banking Corp.’s (RCBC) dynamic business continuity plan.

When news of the first Philippine COVID-19 case broke out, we immediately rolled out the drawing board. While hoping for the best, we prepared for the worst. We subscribed to the work-from-home setup, a week before enhanced community quarantine was declared on March 16.

The pandemic indeed has forced all stakeholders to go digital. The government mandated that all its transactions quickly transition to electronic for swift delivery of public services. RCBC heeded this call by promptly scaling-up key digital platforms, and inking over 50 key partnerships vital to social service delivery.

This includes government agencies like the Department of Trade and Industry (DTI) for digitally enabling micro, small and medium enterprises, and the Department of Social Welfare and Development (DSWD) and Department of Labor and Employment (Dole) to assist in the efficient and fast digital disbursement of cash assistance to sectors affected by the pandemic under the government programs covered by the Bayanihan 1 and Bayanihan 2 laws.

Scaled up banking services, like the RCBC’s hand-held automated teller machine (ATM) mobile point-of-sale device called ATM Go, met the challenge head on. Nationwide, more than 1,800 ATM Go devices were deployed ahead of the lockdown to hundreds of RCBC payout partners in 72 of the 81 provinces, the first private universal bank to do so in this magnitude. Partners include rural banks, microfinance institutions, cooperatives, pawnshops, money business operators, drugstores and “sari sari” stores.

The DSWD tapped RCBC’s ATM Go and endorsed its use across its regional offices as the disbursement device to service ATM cards issued by any Bancnet-member bank including cash cards used for its conditional cash transfer program called Pantawid Pamilyang Pilipino Program. And for the digital “ayuda” disbursements of social amelioration program, both the DSWD and Dole tapped the new RCBC DiskarTech disbursement platform.

As of Dec. 24, over P12 billion has been disbursed to about 3.17 million households benefiting approximately 15.83 million individuals nationwide.

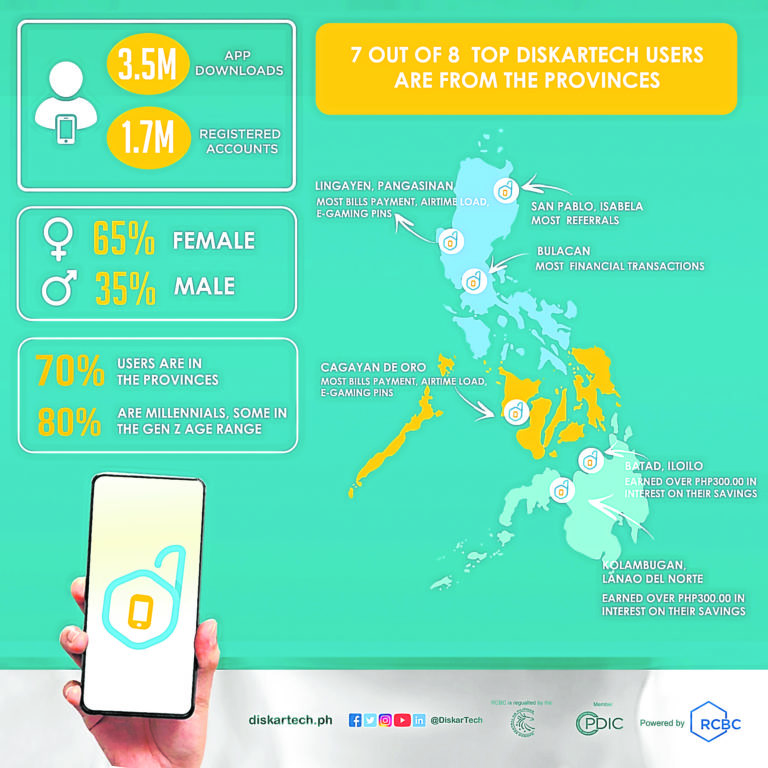

On the mobile app front, covering the entire market spectrum has been the emphasis. This is a testament to RCBC’s thrust of not only being the bank for all generations, but for all segments of society as well.

Exceeded metrics only stoke the determination to continuously enhance user interface, and to optimize digital customer experience. These efforts further set unprecedented milestones, such as the recorded jump of 681-percent in InstaPay fund transfers compared to prequarantine figures. Daily transaction count and amount of cardless ATM withdrawal were up by 2,763 percent and 4,535 percent, respectively. Alongside these are digital banking enrollment and send cash remittances, which surged by 186 percent and 523 percent, respectively.

Even at the height of the lockdown, scale-up efforts remained razor focused on trailblazing online and mobile features responsive to the call of the times, such as the use of virtual banking technology to provide secure and more convenient alternatives for various financial transaction across segments.

Read full story here.