By Fintech News Philippines

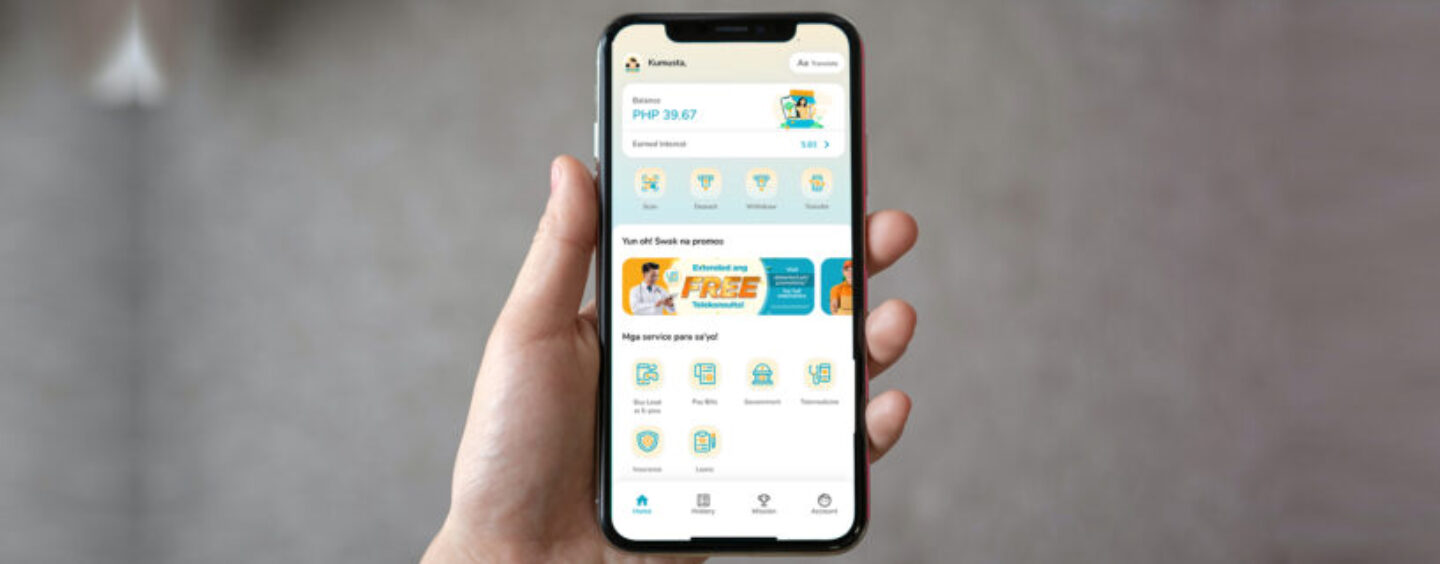

Rizal Commercial Banking Corporation (RCBC), with its flagship financial inclusion app DiskarTech, has reached a five-digit organic growth in partner deposits by end of October versus same period last year.

DiskarTech’s partner deposits recorded a 69,526 % and 12,765 % surge in transaction value and volume respectively with close to 3 billion pesos in cash-in value.

These cash-in and deposit transactions are being done in over 45,000 touchpoints nationwide.

InstaPay outgoing registered a growth of 2,340 % and 25,526 % in transaction volume and value, respectively, while InstaPay incoming booked 790 %a nd 2,521 %, respectively.

Formed under the framework of the National Retail Payment System, InstaPay is governed by the Philippine Payment Management Inc. under the oversight of the Bangko Sentral ng Pilipinas.

Additionally, bills payment transactions also a big jump to 2,978 % and 3,892 % in volume and value, respectively.

As of end October, DiskarTech has also booked a gross transaction value in excess of P14.9 billion.

See full post here.